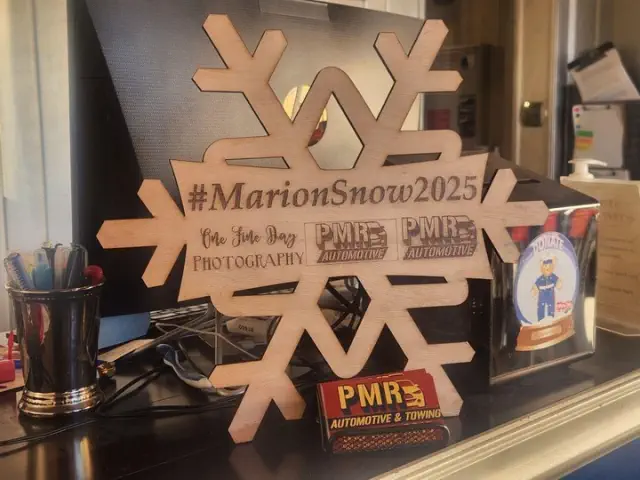

The Snowflake Chase event in Marion encourages residents to support local businesses this winter season.

View pictures in App save up to 80% data. Participants in the Snowflake Chase must take a selfie featuring a uniquely crafted snowflake at each of the 23 participating locations and share it using the hashtag #MarionSnow2025. MARION — Small business owners often view January and February as a sluggish period, as shoppers deal with the aftermath of the holidays and face the challenges of winter weather. However, two entrepreneurs from the area are collaborating to highlight Marion's local businesses through the Marion Snowflake Chase. This event encourages participants to explore 23 different spots, including a variety of restaurants, shops, and more.

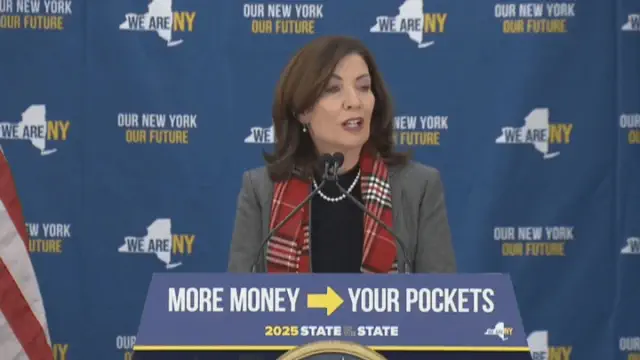

Kathy Hochul Unveils $3 Billion Relief Initiative to Enhance Family Finances and Consumer Expenditure

View pictures in App save up to 80% data. Meaningful Financial Assistance Governor Kathy Hochul has unveiled a new initiative that includes $3 billion in inflation refund checks for families, providing much-needed financial support during tough economic circumstances. This initiative is designed to boost consumer spending throughout New York, catering to the urgent needs of numerous families while also promoting overall economic development. Picture the sense of relief this brings to households statewide, easing financial burdens just in time for the holiday season. Enhancing the Child Tax Credit In a significant initiative, the proposal suggests an enhancement of the Child Tax Credit, expected to assist around 2.75 million children. This enhancement highlights the importance of investing in family finances, allowing parents to obtain necessary resources and foster a better future for their children. When families experience financial security, they become more assured in their spending, which creates a positive impact on the local economy. Increased financial stability results in greater consumer confidence, benefiting retail, services, and various sectors alike. The Importance of Accessible Child Care The economic approach extends beyond just direct refunds; it includes strategic investments in accessible child care services. One of the biggest challenges for new parents is securing quality and affordable child care. By prioritizing this issue, Governor Hochul's initiative guarantees that families will have access to reliable care that doesn’t strain their finances. Affordable child care is not just a nice-to-have; it's essential for working families trying to juggle their professional and personal lives. With more accessible options at their disposal, parents can focus on their careers, thereby boosting productivity and fostering economic development. Promoting Home Ownership In addition to providing assistance for child care, this proposal emphasizes the importance of investing in home ownership. For numerous families, owning a home is a crucial objective that symbolizes not just a residence but also a worthwhile long-term asset. Improved economic circumstances, facilitated by refunds and credits, could enable more families to achieve this dream, thereby fostering community stability. Home ownership fortifies neighborhoods and plays a vital role in the broader economic landscape, as those who own homes are generally more inclined to invest in their communities. Sustained Economic Consequences While the short-term advantages of these initiatives are remarkable, a closer look at their lasting effects uncovers even more significant benefits. Enhanced consumer expenditure plays a vital role in maintaining economic recovery. When families obtain direct financial support, the focus can transition from just getting by to strategizing for the future. A flourishing economy supports local businesses, stimulates job growth, and improves the overall quality of life within each community. Focusing on At-Risk Families The proposal centers on supporting vulnerable communities that have been disproportionately affected by economic challenges. By emphasizing programs aimed at enhancing financial security, Governor Hochul's strategy aims to create a foundation for substantial decreases in poverty rates. The investments are directed towards families who are finding it difficult to meet basic living needs, guaranteeing that every child can rest easy, knowing that they will not go to bed hungry and that their family is secure. Bipartisan Cooperation and Unity To ensure that a comprehensive package achieves significant impact, it is crucial to secure backing from a range of stakeholders. Cooperation across party lines can aid in formulating clear regulations that improve the effectiveness of these initiatives. Involving local leaders and community representatives helps to acknowledge and incorporate the specific requirements of different populations, leading to a more seamless and successful implementation process. Fostering Community Involvement A frequently neglected element in financial programs is the significance of fostering community involvement. When citizens are made aware of the resources at their disposal, they are better equipped to reap the rewards available to them. Hosting workshops and information sessions can enable families to grasp how to effectively use refunds or enhanced credits, transforming theoretical ideas into practical steps. As communities come together to support these initiatives, a shared sense of purpose develops, bringing families together in pursuit of common objectives and dreams. Final Thoughts Kathy Hochul's initiative goes beyond simply providing financial assistance to families; it represents a commitment to the future of New York. The total impact of $3 billion in refunds, enhanced child tax credits, affordable child care, and support for home ownership creates significant growth opportunities that extend beyond simple statistics. As we navigate this path to economic recovery, every family is poised to benefit, paving the way for a more prosperous future for generations ahead.

BlackRock is anticipated to report impressive earnings, as Larry Fink's company pivots away from its previous focus on socially conscious investments.

In case you missed it, BlackRock — indeed, that BlackRock — is shifting away from its progressive stance. Furthermore, it’s not facing any financial troubles, as On The Money has discovered. On Wednesday, just before the market opens, the largest money management firm in the world is set to announce its earnings for the fourth quarter as well as its financial results for the entire year. According to my contacts on Wall Street, both are expected to illustrate that their operations are operating at maximum capacity. Confluence doesn’t necessarily equate concurrence, of course. But it’s remarkably obvious that at a time when BlackRock has dialed back its overt progressive posturing — leaving, as the Post reported last week, a UN-sponsored group of environmental activists — its financial performance is soaring, at least according to the Wall Street buzz. One significant factor is that the backlash from conservative critics regarding its so-called ESG investing has diminished as the organization has distanced itself from being a fervent proponent of the woke investing approach. View pictures in App save up to 80% data. Larry Fink's BlackRock has exited a UN-backed coalition of environmental advocates, coinciding with the company's remarkable performance surge. Additional Insights from Charles Gasparino Treasurers in Red States continue to view BlackRock's CEO Larry Fink with a degree of skepticism, though that sentiment has softened recently. They have mostly ceased their harsh criticisms of him as a proponent of "woke" ideology. Additionally, many have refrained from withdrawing funds from the firm now that he has toned down his embrace of progressive initiatives. By shifting its emphasis away from political matters and concentrating more on business, BlackRock is experiencing significant growth. Its assets under management are projected to exceed $11.5 trillion, despite the fact that recent increases in interest rates may negatively impact its fixed income investments. Analysts believe that the company's earnings will remain robust despite the increasing interest rates, thanks to its diversified operations. While major asset managers are grappling with client pressure regarding fees and experiencing withdrawals, BlackRock managed to attract a significant influx of capital last year from various channels, including pension funds and individual investors, according to sources. View pictures in App save up to 80% data. The backlash from conservative critics regarding its alleged ESG investing has diminished as it has distanced itself from being a strong proponent of the progressive investment approach. BlackRock is making significant strides in the cryptocurrency space. If you examine the rankings of the largest Bitcoin holders, you'll find that in a relatively brief timeframe, BlackRock — representing traditional finance — has positioned itself just below the legendary Satoshi Nakamoto and the prominent crypto exchange Binance. As of January, it possesses approximately 560,000 bitcoins valued at roughly $55 billion, making it the leading player in the Bitcoin market due to its highly sought-after Bitcoin ETF. According to sources, the inflows into the ETF have remained consistent, as will be highlighted in the upcoming earnings report. BlackRock chose not to provide a statement for this report due to its inability to offer pre-earnings forward guidance. However, my sources maintain that Fink is poised for a well-deserved triumph. Yes, I know, Fink says a lot of stuff — some of which has gotten him in trouble in his advocacy of Environmental Social Governance investing. The investment style, his critics alleged, channeled progressive politics on issues like energy conservation through the investment process. In recent years, he earned the ire of the both Red State GOP-run pension funds, and Republicans in Congress even as he won plaudits from the political left for using BlackRock’s investment might to enact social change. But with the growth of Red State populations and their pension funds, Fink’s ESG posturing was costly; assets declined around $1 trillion in 2022. I have a deeper understanding of Fink than his detractors do, and the portrayal of him as merely an admirer of Elizabeth Warren is completely inaccurate. View pictures in App save up to 80% data. Fink often shares a variety of opinions, some of which have led to controversy in his support for Environmental Social Governance (ESG) investing. Fink founded BlackRock three decades ago with no assets, and he didn't grow it to over $11.5 trillion through leftist ideologies. He is recognized as one of the top risk managers on Wall Street, a reputation earned through years of bond trading and valuable lessons learned from his setbacks, unlike many of his peers. This expertise is a key reason why, at 72 years old, he continues to thrive as CEO. I have indicated that he took significant risks regarding ESG due to financial motivations. He successfully secured a substantial amount of left-leaning pension investments in New York and California. However, as early as 2021, he recognized potential issues and began advocating for a shift towards sustainability, warning that without it, there would be a decline in oil drilling and an increase in inflation. Since then, he has been distancing himself from ESG, diminishing its focus in the management of non-ESG assets. As I revealed earlier, he abandoned a crucial UN-supported asset management organization last week that was committed to achieving net-zero carbon emissions by 2050. Here’s a fascinating tidbit: In conservative political circles, detractors of Fink often refer to him as “Mr. ESG.” Meanwhile, a fresh wave of younger investors has dubbed him “Mr. Bitcoin,” even though he previously labeled the cryptocurrency as an “indicator of money laundering.” View pictures in App save up to 80% data. Fink founded BlackRock three decades ago with no assets, and he didn't grow it to over $11.5 trillion through leftist ideologies. He acknowledged his error and introduced the Bitcoin ETF nearly a year ago in January 2024. Since then, it has risen by almost 125%. When you rise on Wednesday, I’ve heard that BlackRock will be showcasing its impressive performance. I'm sure Fink will be celebrating on financial television. He ought to, as it's no accident that when he and the company became less aware of social issues, they distanced themselves significantly from financial struggles.

The GOP's suggested budget reductions aim at Medicaid and SNAP assistance programs.

View pictures in App save up to 80% data. For countless families in the Mahoning Valley, assistance programs such as Medicaid and SNAP serve as essential support systems. A plan put forth by House Republicans aims to slash federal expenditures on various programs by trillions over the next decade, intending to finance the continuation of tax cuts that were initially enacted in 2017 during the first term of the president-elect. John Woods, the proprietor of Insurance Navigation, expressed that this situation could result in greater difficulties for individuals who are covered by Medicaid. "Woods stated, 'The individuals who truly benefit from Medicaid often aren't the most vocal. They are those who are in need and face financial instability, which could result in increased medical debt.'" As reported by the Ohio Medicaid Dashboard, approximately 200,000 individuals in the Mahoning Valley have Medicaid coverage. Republican legislators are seeking to slash billions from Medicaid by decreasing federal funding and transferring that burden to individual states. The Republicans are targeting more than just health care for cuts. They are also aiming to save $300 billion by slashing SNAP benefits. Mike Iberis, the Executive Director of the Second Harvest Food Bank, is concerned that this situation may result in an increased demand for assistance within the community. "Iberis mentioned that when individuals exhaust their funds by the month's end or at the conclusion of a billing cycle, they often turn to food pantries. This trend could lead to an increase in the number of people seeking assistance from our pantries." Over 100,000 individuals in the Valley are beneficiaries of SNAP assistance. "Woods remarked, 'We are already facing significant challenges with food deserts; this only adds to an already dire situation.'"

Discover Which Cities in Montana Feature the Priciest Real Estate

Is Buying a House in Montana Within Your Budget? View pictures in App save up to 80% data. Nick Northern The American Dream has always involved home ownership, but it's becoming increasingly hard in places like Montana. We've been named the most unaffordable place to live recently and it might not get any better if we keep seeing home prices like the ones you'll see below. CONTINUE SCROLLING TO DISCOVER THE HIGHEST HOME VALUES IN MONTANA 👇 View pictures in App save up to 80% data. Canva What Is The Typical Price for Purchasing a Home in Montana? It's no secret that places like Bozeman, Whitefish, and Big Sky have home values through the roof, but the average for homes across Montana right now sits at $468,195, up 2.8% from last year. That is well above the average home value in America, which currently is $362,143, and is also up from last year by 2.5%. Add in the 6.88% 30-year fixed mortgage rate (as of January 14th, 2025), and it's very expensive and almost impossible for first-time buyers to afford to purchase a home right now. View pictures in App save up to 80% data. Canva Who is responsible for the soaring housing prices in Montana? Many people tend to blame newcomers relocating to Montana for purchasing homes (often with cash) at prices exceeding the original listings. Although that situation does occur, should we hold them accountable, or should the responsibility fall on the sellers instead? To be honest, if presented with the opportunity to sell your home for a price that exceeds its actual value, would you really pass it up? Once you realize the potential benefits of owning a home in any of these locations, I believe you'll find yourself contemplating the idea quite seriously. These Cities Currently Feature The Priciest Homes In Montana Stacker compiled a list of cities with the most expensive homes in Montana using data from Zillow. Cities are ranked by the Zillow Home Values Index for all homes as of November 2024. The charts in this story were created automatically using Matplotlib. Gallery Credit: Stacker CONTINUE EXPLORING: Unveiling The Top 8 Mountain Towns in Montana The realty group Montana West Realty has come up with their list of the 8 best towns in Montana offering up a mountain view. Gallery Credit: Nick Northern CHECK IT OUT: Items That Have Become Too Costly for Montanans to Afford Buzzfeed recently conducted a survey that asked folks what they're cutting back on in an effort to try and save money. Although not everything on that survey relates to Montanans, the ones that mainly do are listed below. Gallery Credit: Mike Brant

Did a wildfire cause damage to your home? Here are the steps you should take next.

View pictures in App save up to 80% data. Getty Images/fStop图库 Regardless of whether you’ve experienced a fire or a flood, the guidance remains consistent: Record the damage thoroughly and reach out to your insurance provider without delay. Regardless of whether you’ve experienced a fire or a flood, the guidance remains consistent: Record the damage thoroughly and reach out to your insurance provider without delay. Getty Images/fStop图库 Allie Volpe is a senior reporter at Vox covering mental health, relationships, wellness, money, home life, and work through the lens of meaningful self-improvement. In the midst of the devastating wildfires that have raged through the Los Angeles area over the last week, thousands of residents are grappling with the fallout, from the tangible losses — more than 12,000 structures were damaged or destroyed — to the sentimental — generations of memories gone. What can be even more overwhelming for victims is figuring out what to do next and how to begin to recover. Californians aren’t alone. In recent years, major natural disasters have devastated communities throughout the country. Last fall’s Hurricanes Milton and Helene damaged or destroyed hundreds of thousands of homes. Over 2,200 structures were destroyed in the 2023 Maui wildfires. According to Bankrate’s 2023 Extreme Weather Survey, over the past decade, 57 percent of US adults were forced to shoulder costs because of hurricanes, tornados, wildfires, earthquakes, flooding, or heavy snow events. In the aftermath of such events, residents likely need to file insurance claims and apply for assistance. This process can be arduous, with those impacted required to submit detailed lists of items lost — according to a 2023 Insurance Information Institute survey, fewer than half of homeowners had prepared personal inventories of their belongings to document such losses. Making matters more complicated, in California, a home insurance crisis looms after thousands of homeowners in fire-prone areas were recently told that their policies were not being renewed. The state has some safeguards in place: Those dropped from their plans could enroll in California’s FAIR plan, an insurance program that the state established in the late 1960s that offers minimal fire coverage for high-risk properties as a last resort. Recently implemented insurance reforms in California will also require insurers to offer new policies in fire-prone areas and could bring back insurers like State Farm that previously dropped policy holders in high-risk regions. Individuals lacking insurance can seek assistance via the Federal Emergency Management Agency or local state support programs. Here’s a guide on initiating the process to obtain help. The first step you should take is to contact your insurance provider. After local authorities have deemed it safe to return to your home after a disaster, assess the damage and reach out to your insurance company by phone or app to start a claim as soon as you can. Take photos and videos of any damage — don’t throw away damaged items or make repairs until an insurance adjuster has completed their assessment. There may be delays due to the ongoing nature of the disaster, as well as its scope, says Jeff Schlegelmilch, the director of the National Center for Disaster Preparedness at the Columbia Climate School. Fires are still ongoing, and it may be unsafe for adjusters to access the area. The number of homes that were impacted and need to be evaluated can add to the lag. “Don’t make repairs before your insurer has assessed the damage, as it may void your coverage,” George Hooker, an attorney at Cole, Scott, and Kissane who specializes in property insurance claims, said by email. If you took pictures and video documentation of your home and belongings before the damage, this can be useful to substantiate your losses with your insurance company. Fortunately, damage from smoke and fire is covered under standard homeowner and renters insurance policies in California, according to the Insurance Information Institute. California regulation requires homeowners and renters insurers to immediately pay policyholders one-third of the estimated value of their belongings and a minimum of four months’ rent in the event that you are completely displaced, known as additional living expense. The FAIR plan covers up to $3 million in damages for residential policyholders and only reimburses the cost of renting a property that’s similar to your home. Keep all receipts for expenses like lodging, car and furniture rental, or laundry so you can be reimbursed later. Inquire with your insurance provider about when they will be able to assist you. Hooker suggests, “Certain insurers provide emergency response services to help protect your property and prevent additional damage.” Be sure to obtain a claim number and note it down, as it will be useful for tracking the progress of your claim later on. Follow up with your insurance company if they haven’t scheduled your assessment. After an adjuster assesses the damage, they will determine how much the insurance company will pay you. You may be given a settlement offer on the spot, but do not sign offers right away, as you may be entitled to more money. If you disagree with the assessment from your insurance company, you can hire a public adjuster for a fee. Their second opinion can help you when negotiating with your insurance company. You can also appeal any decisions made by your insurance company. Keep detailed notes and send a follow-up email after every conversation with an insurance representative or adjuster to document your progress. If the claim is accepted, you may receive one or multiple checks based on the extent of the damage. The amount of time insurance companies have to pay out claims depends on where you live. States like Arizona and Kentucky must send checks within 30 days while Texas laws require insurers to send payment within five days. Claims involving mortgage lenders and for significant damage can take longer to process; you can file a complaint with the state’s insurance department if your insurance company is dragging their feet. Usually, though, insurance companies are fairly prompt in paying disaster victims, Schlegelmilch says. According to Hooker, tenants who have rental insurance should contact their insurance provider and record any damages as soon as it is safe to access the property again. Regardless of whether you've experienced a fire or a flood, the guidance remains consistent: Make sure to record the damage and reach out to your insurance provider promptly, advises Hooker. “It’s worth noting that some types of damage may be covered differently depending on the disaster,” he says. “For instance, standard homeowners’ insurance policies usually do not cover flood damage, so it is useful to check on the type of coverage you have.” The National Association of Insurance Commissioners has a detailed step-by-step guide on how to submit an insurance claim after a natural disaster and how to navigate the process moving forward. What steps to take if you lack insurance coverage. For those without homeowners or renters insurance, you can apply for relief through FEMA. (Those with insurance are also eligible for FEMA assistance.) Fill out the application at DisasterAssistance.gov, on the FEMA app, or by phone at 1-800-621-3362. You’ll need your Social Security number, description of the damage caused, your annual household income, contact information, and bank account information for direct deposit. A FEMA inspector will call and ask about your damages within 10 days of applying for aid. You’ll receive an eligibility decision within 10 days of that call. If you’re eligible for aid, you’ll receive a check or direct deposit at that time. FEMA assistance can be used to pay for rent or lodging expenses if you are displaced and home repair and replacement. Applicants can expect to receive this aid fairly quickly, Schlegelmilch says. Hooker also suggests checking if your state or city is offering disaster relief. Aid organizations like the American Red Cross and the Salvation Army operate shelters and service sites offering access to caseworkers to help with financial assistance. Disaster assistance centers serve as a place for individuals to consult with case managers regarding their eligibility for various forms of aid. According to Schlegelmilch, having insurance may disqualify you from receiving certain types of public assistance. He explains, “The dynamics can be quite intricate.” Therefore, he recommends that individuals seek help from disaster assistance centers or trustworthy nonprofits that specialize in disaster case management, as they are the most reliable resources for guidance. Additionally, if it's within your means, some law firms offer support to disaster victims in accessing available aid. Once more, you can locate these centers by visiting the website of your local emergency management office or checking the websites of organizations such as the American Red Cross, Catholic Charities, and the United Way in your area. Some banks also offer disaster assistance. US Bank runs a disaster hotline to help customers determine which programs they’re eligible for. Golden 1 Credit Union’s Community Emergency Relief program provides loans with flexible payment options. Check with your bank to see if they have disaster relief programs available. Searching for a place to call home. To find immediate shelter housing, DisasterAssistance.gov has an emergency shelter page with resources for housing. The California Office of Emergency Services also has a list of available shelters. You can learn about other disaster assistance programs and housing and rental assistance information at a Disaster Recovery Center. To find one near you, enter your address in FEMA’s DRC locator. You can use the cash advance your insurance company gave you for additional living expenses to help pay for temporary housing. After you apply for disaster assistance through FEMA, you may find out you qualify for transitional housing, which covers hotel stays while you’re displaced. Airbnb is also offering free temporary housing for people impacted by the wildfires in the Los Angeles area. Fill out the application for housing through the county website. Dozens of Southern California U-Haul facilities are offering free storage options for those impacted by wildfires. You’re still responsible for making mortgage payments even if a disaster has destroyed your home, but you can request mortgage forbearance to pause or lower payments by calling your mortgage lender. If you’re a renter, you have the right to terminate your lease if you’re unable to live in the property. Refer to your lease for instructions on how to either pause rent payments or terminate the lease. For help paying for longer-term housing, FEMA offers continued temporary housing assistance programming. Eligible residents who need more than two months of FEMA rental assistance can apply to receive rental assistance for another three months or longer. Renters and homeowners can call FEMA’s helpline at 1-800-621-3362 to request an application. Outside of FEMA assistance, residents may need to secure housing on their own, a process only made more difficult by housing shortages and price gouging. Six months after the Maui wildfires, thousands of residents struggled to find housing. Already, rents are skyrocketing in Los Angeles. Potential housing options include extended stay hotels, short term rentals, and corporate housing that accepts public customers. United Corporate Housing and Corporate Housing by Owner, for instance, are offering temporary housing for California wildfire victims. While the recovery from natural disasters often takes years, there’s still a lot of help that impacted residents can get now. Stay patient, take detailed documentation, and continue to fight for what you deserve.