Impact investing has gained significant momentum over the past decade as investors increasingly seek to combine financial returns with social and environmental impact. Unlike traditional investing, which focuses solely on maximizing profits, impact investing aims to create positive change in society while generating competitive returns.

One of the main drivers of impact investing is the growing awareness of global issues such as climate change, income inequality, and access to education. Investors are recognizing that businesses addressing these challenges have the potential to thrive in the long term, as consumers and governments demand more sustainable practices.

Impact investments can be made in various sectors, including clean energy, education, healthcare, and affordable housing. Many investors choose to focus on companies that prioritize ESG (Environmental, Social, and Governance) factors, ensuring that their investments align with their values.

While impact investing offers the potential for both financial returns and social good, it’s important to approach it with the same rigor as any other investment strategy. Investors should carefully assess the financial health of the companies they invest in, as well as their ability to deliver measurable impact.

Recent

See All2025-04-04

Economic Strength Bolsters Market Upturn

2025-04-04

Exploring the Investment Terrain: Key Strategies for 2025

2025-04-04

Navigating the Global Economic Recovery: What’s Next for 2025?

2025-04-04

The Role of ESG Investing in Shaping the Future Economy

2025-04-04

The Impact of Artificial Intelligence on the Financial Sector

2025-04-04

The Future of Cryptocurrencies: Are They a Safe Investment?

2025-04-04

San Francisco’s New Mayor Pledges to Boost Public Safety and Revitalize Local Economy

2025-04-04

Sitka Gears Up for a Possible Special Election Regarding Cruise Ship Restrictions

2025-04-04

Why Diversification Remains the Key to Investment Success

2025-04-04

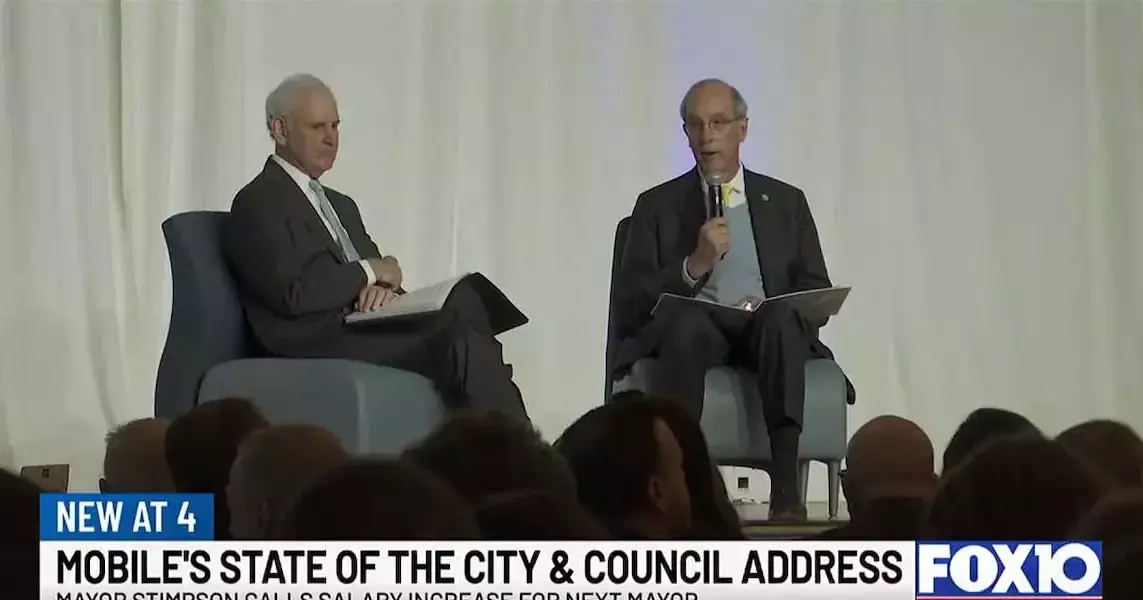

Rethinking Mayoral Pay: A Progressive Proposal for Enhanced Compensation

Newsletter

Get life tips delivered directly to your inbox!